Enhancing the transparencyof critical business process through

Digitisation &Automation

Kreditserve’s suite of products help successful businesses and B2B marketplaces in strengthening and leveraging their ecosystems and deepening the partnership with their supply chain partners.

Our goal is to provide platforms for established businesses and B2B marketplaces (‘Anchors’) to leverage the strength of their supply chain ecosystems. The products empower the small and medium businesses in the Anchor’s ecosystem with data and capital, while using the smartest and most innovative technology enabled financial solutions. In doing so, Kreditserve help Anchors deepen their relationship with their ecosystem partners, gain important insights into their partner’s capabilities and needs while at the same time enhancing their margins.

Our Edge

- Deep understanding of supply chain practices

- Experience of underwriting credit and structuring risk

- Sound understanding of the needs of institutional lenders

- Experience of creating financial products for family offices and wealth tech firms

- Customisable digital workflows for speed of implementation

- API integrations to access real time transaction data

- Proprietary models for automated underwriting

- Cloud native designs and micro services architecture

- Layered security for database, network and compute resources

Solutions

Corporate Anchor

- Integration with Anchor’s payables platform

- Vendor portal to digitise vendor/anchor interactions

- Offer early payment solutions to vendors

- Enhance anchor profitability

Digital Marketplaces

- Integrate with the marketplace front end

- Provide credit solutions to both Buyers and Sellers

- Exclusive digital credit provider to participants in the marketplace

SaaS Provider

- Source data from SaaS providers

- Build credit models using this data

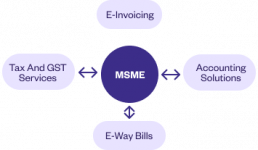

- Offer credit solutions to MSMEs based on this data

- Help SaaS provider in monetizing their data

The best way to predict your future is to create it

Abraham Lincoln

Our Approach

A platform solution that creates an Efficient (low cost), Calibrated (risk controlled) and Scalable methodology to deliver tech-enabled credit solutions to small businesses (MSMEs). The technology first approach enables Anchors to leverage their existing supply chain data to offer competitive and innovative financial solutions to their ecosystem partners while optimising their margins.

Efficient

- Anchor relationships help reduce the cost of customer acquisition

- Digital workflows and KYC to reduce on-boarding costs

- API integrations for efficient and automated data transfers

Calibrated

- Product designed to structure and distribute risk

- Real time transaction data through tech integration improves underwriting quality

- Proprietary scoring models leveraging digitally accessed data

Scalable

- Reduce underwriting discretion due to standardized credit models

- Innovative approach to liabilities targeting family offices

Our Team

Vikram Nirula has over 20 years of underwriting and investing experience in India. He has been a founding team member of a private equity fund called True North (earlier called India Value Fund) and MD at The Carlyle Group. Vikram has invested in and managed a portfolio of several financial services, consumer and manufacturing companies. Vikram is an MBA from the Indian institute of Management – Bangalore and an engineer (computer science) from the Birla Institute of Technology.

Saif Hasan has more than 15 years of Sales and Strategic Alliances experience With Consumer Banks and Private Wealth Firm He was Director with IIFL Wealth . Prior to IIFL, he used to head Citibank consumer branches in Mumbai, leading teams on Liabilities, Assets, Insurance, Wealth and Operations. Saif is a Post Graduate in Business Economics( MBE) from University of Delhi and a Graduate in Commerce from BHU.

Presently Founder, CEO of a software solutions company based in Mumbai. Greater than 17 years of experience in consulting developing and operating end to end solutions for the alternative asset management industry. He holds a MBA and BS in Computer Science from a leading university in United States.

Prajit has over 20 years of experience in the corporate bank, Investment Bank and Fintech platforms. He was the COO of Morgan Stanley’s Global Research Operations team based in Mumbai. Before joining KreditServe, Prajit headed the Operations at RXIL (TReDS platform). Prajit holds the PGPMAX (Global MBA) degree from Indian School of Business (ISB).