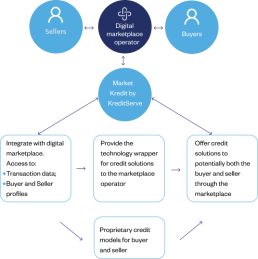

Financial expertise and credit solutions for marketplaces

- MarketKredit integrates with the marketplace's frontend and offers credit solutions to both buyers and sellers

- Credit availability can significantly enhance transaction volumes at the marketplace

- Takes on the responsibility of designing and offering credit solutions to the marketplace participants. Allows the marketplace to focus on its core business

- Integrates with multiple lenders at the backend

- Lenders get access to high quality transaction data and risk scoring models

What KreditServe brings to marketplace

The B2B eCommerce market is ripe for transformation. Business buyers are seeking the same digital buying experience they enjoy as consumers, and business merchants are looking for ways to drive average order value (AOV), same-session checkout rates and customer loyalty.

Financial Solutions

Embedded Finance

Co Lending Models

Setting up limits for buyers and sellers

MSME cards

Technology Solutions

API integrations for Multi Lender Connect

Collection Stack

Integration with Third party services

Automate E-Nach

Virtual Accounts and B2B Payments

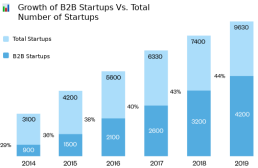

Potential and growth of B2B Market places

- Indian B2B start-up ecosystem growing rapidly

- 44% of all start-ups are B2B start-ups

- Enterprises investing more towards digitization

- Regulatory need: e-invoicing mandate, e-way bill standardization

- Proximity to global R&D centres: India has 1450+global MNCs contributing and driving digital transformation mandates for global HQs

- Abundant presence of digital technology talent

*Source: NetApp Excellerator report, September 2020.